A preliminary look at demand flexibility and peak demand reductions in Canada

Alyssa Nippard

James Gaede

April 30, 2025

Blogs | News

- Demand-side measures like energy efficiency and demand response are essential for managing peak electricity demand and supporting electrification.

- Preliminary comparison suggests Canadian utilities are not reaching the levels of peak demand reductions reported by leading U.S. states.

- Efficiency Canada is embarking on a major research project on the state of demand flexibility in Canada and its role in reliable and affordable energy systems.

A recent study by Efficiency Canada found that utility resource planning has struggled to keep pace with electricity demand growth in recent years. While electrification is widely viewed as the optimal pathway to decarbonizing energy systems, many provinces are also beginning to recognize its economic potential (see Ontario’s energy superpower vision). To realize these objectives while maintaining system reliability and affordability, Canadian utilities will need to capture the full potential of demand-side resources, such as energy efficiency.

Demand-side resources reduce energy consumption, freeing up electricity for trade and electrification and providing needed flexibility to electricity grids. Through measures such as demand response programs, rate schedules, and energy storage, demand flexibility initiatives can shed, shift, generate, and modulate loads to better match the availability of electricity supply. This can help integrate more renewable energy sources, defer costly infrastructure investments, and substitute system capacity from natural gas generation.

One way to represent the contribution of demand flexibility to electricity systems is through peak demand reductions, measured in megawatts (MW). Both demand response and energy efficiency programs can deliver peak demand reductions, though the latter are considered static, while the former can be dynamic and dispatchable when needed.

Efficiency Canada began tracking peak demand reductions in the 2020 edition of the Provincial Energy Efficiency Scorecard from energy efficiency programs and other demand-side management activities, such as demand response programs and interruptible rates. Following established methodologies from the Federal Energy Regulatory Commission (FERC) and the American Council for an Energy-Efficient Economy (ACEEE), we benchmarked these reductions as a percentage of utility annual peak demand.

Using data from our Scorecard report, the ACEEE’s Utility Scorecard, and the U.S. Department of Energy’s Energy Information Administration (EIA), we are thus able to provide a preliminary look at how utilities in both Canada and the U.S. have used demand-side measures to achieve peak demand reductions. There are some caveats, however.

- The most recently available data from the ACEEE is for 2021, so to compare results from 2023, we have used the EIA data. This data is self-reported, however, and our review found some discrepancies between it and the ACEEE data for 2021. While we use the same utility selection methodology that the ACEEE uses for peak demand reductions from energy efficiency programs, the 2023 U.S. data for energy efficiency and demand response results may be less reliable.

- The EIA instructs administrators to report reductions from demand response programs as gross savings at the meter level. ACEEE reports peak demand reductions from energy efficiency programs as net at the generator level, adjusting data using utility-provided or median net-to-gross ratios and line loss factors. To date, Efficiency Canada has not differentiated between net and gross or meter and generator-level in our acquisition of peak reductions data. We note that data in this blog are included as they are found in the source material, and further exploration is underway to clarify reporting methodologies in Canada.

- Utilities may pursue peak demand reductions from demand flexibility initiatives for many reasons, and those not short of capacity may see less need to do so. The comparisons below should thus not be taken as best but as examples of what can be achieved.

Peak demand reductions

In their Utility Scorecard, ACEEE reported peak demand reductions from efficiency programs for 53 of the largest electricity utilities by retail sales. We selected the same utilities from the EIA dataset to get reductions for 2023.

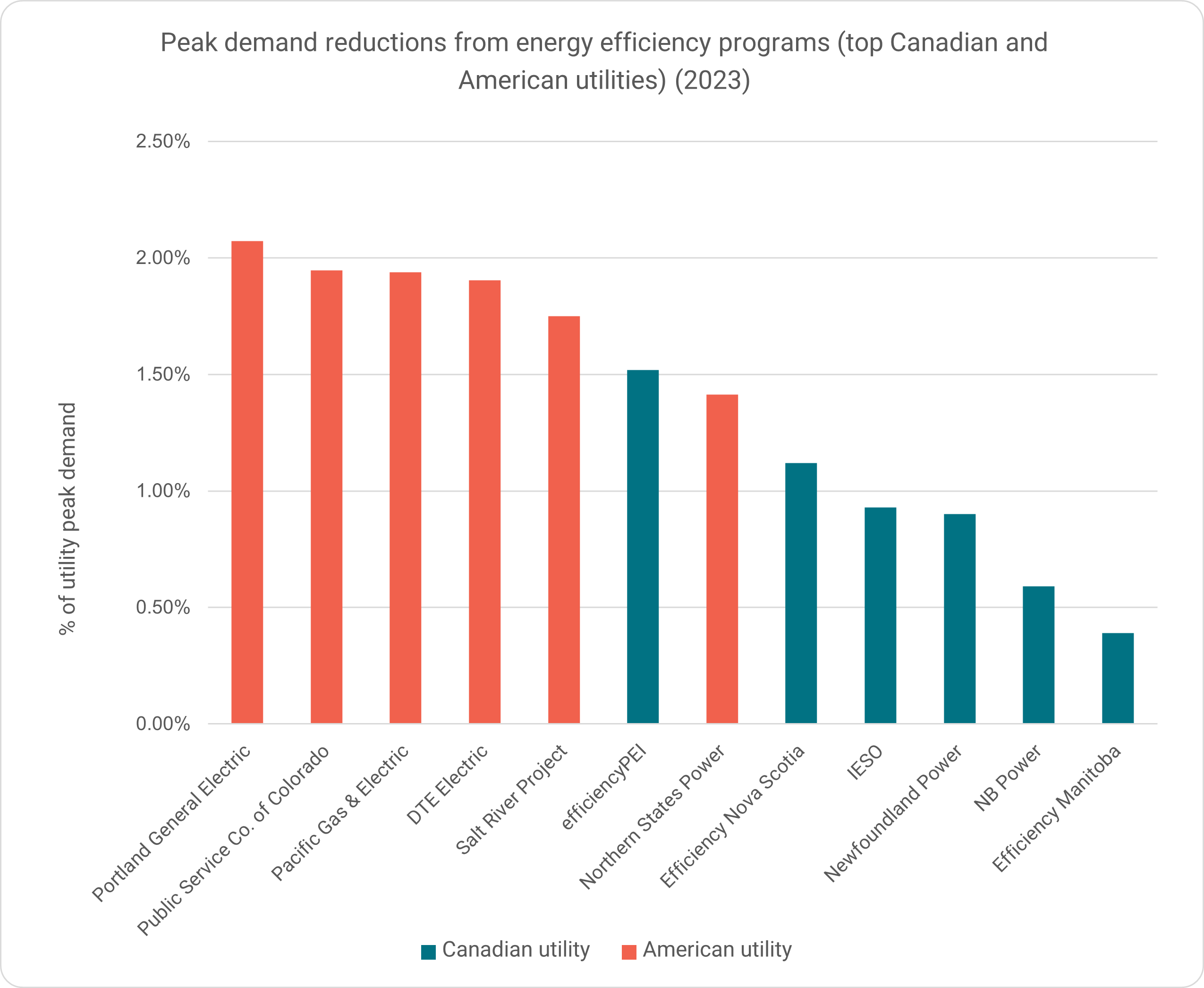

In 2021, 51 of 53 American and eight Canadian utilities reported annual incremental peak demand reductions from energy efficiency programs. Reduction rates across Canadian utilities ranged from 0.2 per cent to 1.4 per cent of peak demand, with an average rate of 0.65 per cent. American utilities’ reductions ranged from 0.01 per cent to 1.9 per cent, with an average of 0.7 per cent. In 2023, the maximum reduction rate achieved by U.S. utilities was 2.1 per cent and 1.5 per cent for Canadian utilities. The graph below shows 2023 results for the six U.S. and six Canadian utilities with the highest peak demand reductions rates.

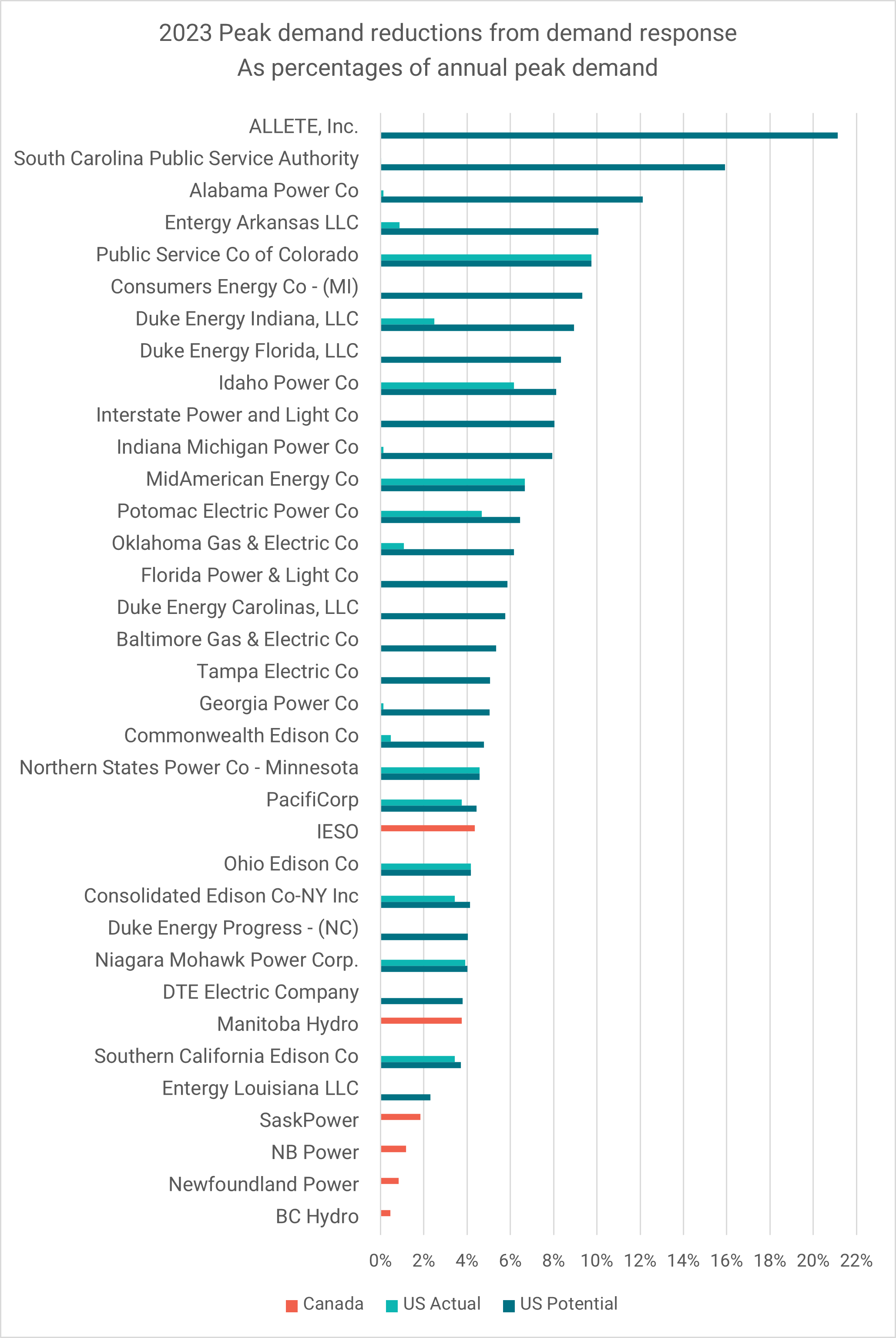

While we are not able to say whether all of these are potential or actual reductions in Canada, it is notable that in this comparison, the maximum reduction rate is still far short of the maximum actual reductions achieved by the U.S. utilities. Our preliminary research suggests that most peak demand reductions come from commercial and industrial demand response programs. For example, roughly 95 per cent of Manitoba’s peak demand reductions come from its curtailable rate program, and results in Newfoundland, Saskatchewan, and New Brunswick are similar. Utilities are beginning to introduce residential programs, such as Ontario’s Peak Perks program, which reported 100 MW of reductions in its first year. Ontario also operates the country’s only capacity auction, which accounted for 3.94 per cent of peak demand reductions in 2023.

Looking forward

What can we take away from this preliminary analysis? No Canadian utility appears to be reaching the levels of peak demand reductions from demand-side measures that some utilities in the U.S. are achieving. As noted above, there could be many reasons for this. It may be that Canadian utilities are not adequately considering the potential of demand-side measures to provide capacity to electricity grids. However, publicly available data on demand flexibility in Canada makes rigorous analysis and benchmarking of the current state difficult, let alone identifying barriers and opportunities to expand the role of demand-side resources.

Over the next year, Efficiency Canada will embark on a major research project to address these issues in detail. The project will assess the state of demand flexibility across provinces through a jurisdictional scan of programs, identify regulatory barriers, and propose pathways to unlock greater potential. In doing so, we hope to contribute to the discussion of how utility demand-side management can be modernized to ensure the continued reliability and affordability of our energy systems.

1 To the best of our ability, we have not included peak demand reductions data from codes and standards work as they fall outside of our scope. Upon recognizing that the majority of San Diego Gas & Electric’s reported reductions (2.63 per cent) were the result of codes and standards work we excluded this utility from our calculations.

2 The EIA dataset includes data from utilities with many different ownership types. We filtered this list to investor or state-owned utilities as these are most comparable with the types of utilities included in our Canadian dataset.